The Global Consequences of Ukraine

May 25, 2014

Justice Department price-fixing probe rattles auto industry worldwide

May 27, 2014Institutional real estate investors have to be creative to find the best opportunities, with some looking to alternative sectors, according to discussions at the RE-Invest Summit at MIPIM

Institutional investors say property is back on track, but finding good opportunities outside Europe in challenging and they have to move outside the gateway cities and be creative to find the best options.

Many investors taking part in the 2014 RE-Invest Summit at the MIPIM overseas property show in Cannes, France, are looking to European markets, but with values high in gateway cities, they are searching elsewhere and investigating alternative options.

The report of the half-day summit, which has just been released, says, “With increasing allocations to real estate in many investor portfolios and with the sense that real estate is back on track as an investment class, investors are concerned that the wave of capital flowing into real estate may be getting ahead of improvement in fundamentals in markets.

“In Europe, many participants expressed a view that real estate is overpriced in core gateway markets, particularly London. Capital is pursuing assets in Southern Europe, particularly Spain, acquiring assets at steeply discounted prices. However, many investors are sceptical that improvement in market fundamentals is forthcoming any time soon.

“Finding good investment opportunities elsewhere is challenging. Several European markets that were highly favoured in recent years are now showing signs that caution is in order. Turkey has experienced political and currency disruptions. Poland continues to have strong economic performance, but overbuilding was voiced as a concern. Despite challenges in Europe markets, this investor group considered Europe a better destination for investment than most other regions globally.

Real estate is back on track to becoming a standard asset class in portfolios globally and with many reporting rising investment in real estate, there is a sense that a lot of capital is scouring the market for remaining opportunities, says the RE-Invest summit report.

“With core assets in gateway markets fully priced, investors have been moving beyond the gateway markets. A question remains where the best opportunities can be found. Investors are questioning whether they are chasing trends or searching for high-quality real estate.

“Core and core-plus assets are believed to be overpriced, which is leading to increased investment in alternative assets and emerging markets. The concern is that a wave of capital is seeking the same assets in same markets driving up prices even in cases where property level fundamentals have yet to appear. Overall, there is a sense that good investment opportunities are available, however, a broader and more creative search is required to find the best pockets of opportunity.”

Others are looking at alternative property types – those that require specific operating knowledge or expertise, including hotels, health care, senior housing, educational facilities, data centres. But they have certain requirements. “Larger investors seem more willing to pursue alternative property types, but want deal structures that allow the investment to perform like real estate rather than like an operating business.”

The Real Estate Invest Survey from audit and tax specialist, KPMG, included in the report says, Germany continues to outperform other countries, with 71% respondents considering it a prime investment destination. Spain is also gradually catching up with the European core markets (UK, Germany and France). France and the US are next in line, posting an equal number of votes at 29% each.

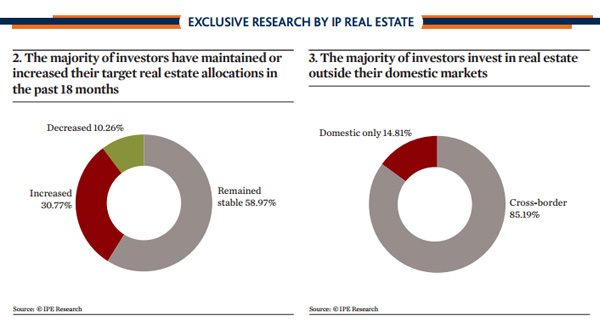

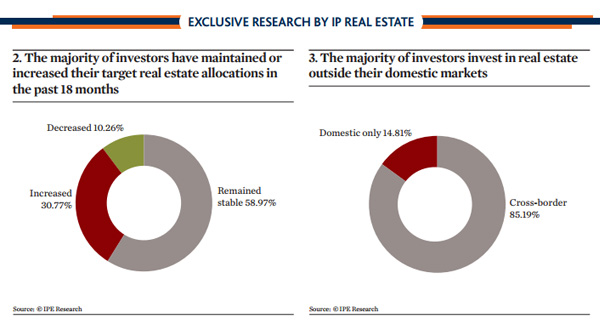

Other research mentioned in the report from IP Real Estate shows 85% of investors are looking to cross-border deals.

Other research mentioned in the report from IP Real Estate shows 85% of investors are looking to cross-border deals.

But as allocations increase, investors are concerned that the wave of capital flowing into real estate may be getting ahead of improvement in fundamentals in markets, the report states.

Within Europe, Spain is of particular interest with investors who see an opportunity to buy at the bottom of the cycle. Some are encouraged by labour reform and progress on the fiscal situation, however, but many question the economic fundamentals in Spain.

“Assets can be acquired well below replacement cost, however with the continued high unemployment and limited growth, the question remains whether these assets will attract tenants any time soon or begin to see income growth.

Investors are also interested in real estate in Italy, Portugal, and Greece due to perceived values in those countries.

Elsewhere in Europe, the UK market is strong, but London in particular is fully priced. Some investors expressed concern that capital flight could occur when other European economies begin to show stronger growth.

Poland, with its strong demographics, continues to grow in popularity among investors, but concerns of overbuilding are beginning to emerge.

Interest in Turkey has been strong in recent years, also due to strong demographics and high growth, however, political instability is slowing investment and investors are generally seeking a higher return premium than in previous years.

Other peripheral markets, such as the Baltics and the Czech Republic, lack the scale to attract large institutional investors, the investors believe.

Those turning to emerging markets agree that the risk is high, so strong real estate fundamentals are of significant importance.

When investing in emerging markets, the focus is often on development opportunities, considering the supply of institutional quality assets is typically quite limited.

Even with strong fundamentals and a good partner, liquidity risk remains, so investors must consider the eventual resale or exit strategy, particularly with shopping malls or large office buildings where a large capital player is required in order to exit the investment. Build-to-suit opportunities for high-credit, international tenants with longer-term leases are a preferred option.

Within the BRIC countries, Brazil and China are seen as having more attractive investment climates, while India and Russia are significantly less popular.

Mexico is a market that is seeing increasing consideration due to its demographics and its correlation to the US market; however, the number of quality assets remains small.

In Africa, funds are beginning to “dip their toes in the water” to gain knowledge for longer term positions, with development being the most likely type of investment.

While China is quite active in Africa, particularly to secure long-term access to commodities, it will likely be 10 years before African investment will be a more appealing draw for institutional investors.

In the United States, the gateway cities remain the most popular markets with foreign investors, but core assets in which they have typically invested are now fully priced if not overpriced. However; investors are now selectively considering well located assets in secondary markets or secondary assets in gateway cities.

The discussion covered only a few markets within Asia Pacific as investors generally see better investment opportunities in Europe than farther abroad. Japan is seen as a difficult country to understand by most, while Australia is seen as having a welcoming investment environment, but high debt costs.

The particpants largely agreed that it is always important to evaluate the real estate opportunity first and then consider any currency implications.

MIPIM RE-Invest included 41 leading industry figures representing seven sovereign wealth funds, 18 pension funds, two foundations, one endowment and one insurance fund from 17 countries with a combined US$300billion allocated to real estate.

By Adrian Bishop, Editor, OPP Connect

Twitter: @oppnews