Ukraine penalty: US, Europe order Russia sanctions

March 18, 2014Ukraine penalty: US, Europe order Russia sanctions

March 18, 2014Executive Summary

The aerospace industry has been on a bit of a tear lately as investors bid up companies that are set to benefit from a secular theme that has emerged within the investing world of a massive increase in commercial airlines and business jet ownership. This is driven by demographics of rising middle classes in Asia, Latin America, Eastern Europe, and the Middle East who not only have the disposable income to travel, but an increased desire to travel. Couple this theme with an insulated, oligopolistic industry that shares risk and effectively restricts new entrants into the market. Lastly, MTU Aero Engines is one the last few standalone maintenance and repair firms that supply spare parts to existing fleets making it a prime takeover target by the larger aerospace players who would see large synergies with their existing OEM operations.

Business Overview

MTU Aero Engines (OTCPK:MTUAY) (OTC:MTUAF) designs and manufactures engine modules for commercial and military aircraft, provides sub-systems, specializing in low-pressure turbines and high-pressure compressors. Their components are used in both brand new engines and as spare parts in the aftermarket. It remains the last remaining independent supplier of certain aero engine sub-systems. The company is now the third largest engine maintenance, repair and operations (MRO) service provider with a market share of 8%.

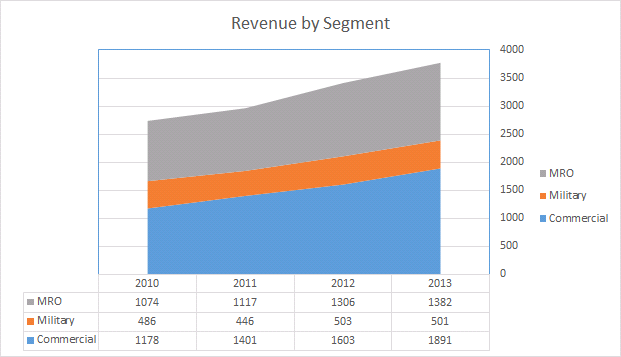

The company operates out of two segments, the OEM business and the MRO operation. Obviously, the OEM business focuses on producing and selling new commercial engines, including some spare parts, along with their military business. The MRO segment comprises all commercial maintenance activities.

Below is the revenue by geography in Euro:

(source: Bloomberg)

(Source: Annual Report)

Industry Opportunity

Aircraft manufacturers are gearing up for a new secular wave of orders amid strong growth worldwide. Global air traffic is forecasted to average approximately 5% per year over the next twenty years. This secular growth is due to a combination of growing disposable incomes, urbanization, and an increasing demand and desire to travel among developing economies while the passenger yield has increased less than incomes increasing affordability. In other words, more people, more wealth, and larger cities.

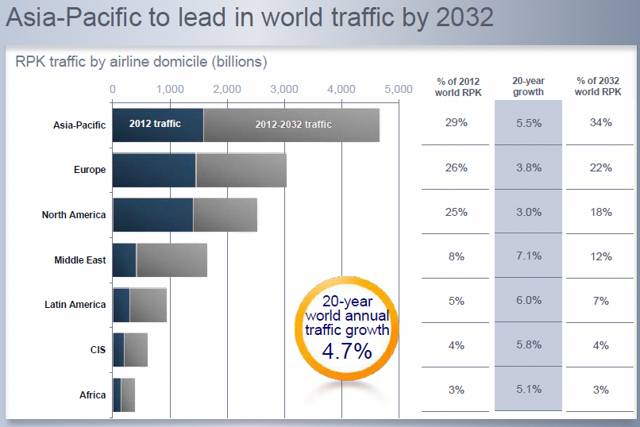

In 2012, RPK (revenue per passenger kilometer) was 5.5 trillion and is expected to increase to 13.9 trillion in by 2032, for a 151% increase. The passenger air fleet is expected to increase by over 100% to 33,651 with a new passenger aircraft deliveries forecast of 28,355. Below is a chart showing RPK according to each region and the potential 20-year growth:

(source: Airbus Global Market Forecast 2013)

While total industry growth is expected to average 4.7% over the next twenty months, Emerging markets will experience significantly faster growth of 6.6% per year. The Asian region is expected to surpass Europe and North America by 2032 in the percentage of air traffic.

Within the manufacturing industry itself, there are several new dynamics at play. For one, the hub-and-spoke model of air travel has been partially replaced as consumers desire lower air travel times equating to more direct flights. This can be illustrated clearly in the estimated growth of new passenger and freight aircraft:

(source: Airbus Global Market Forecast 2013)

Growth of the small, single-aisle aircraft will far outpace the larger aircraft used more for travel between large cities or connecting (hub-and-spoke) travel. The above data excludes private/business jets and only includes aircraft of 100 seats or more. The growth within the small jet market is even more prolific but overall a smaller piece of the overall travel industry dollars.

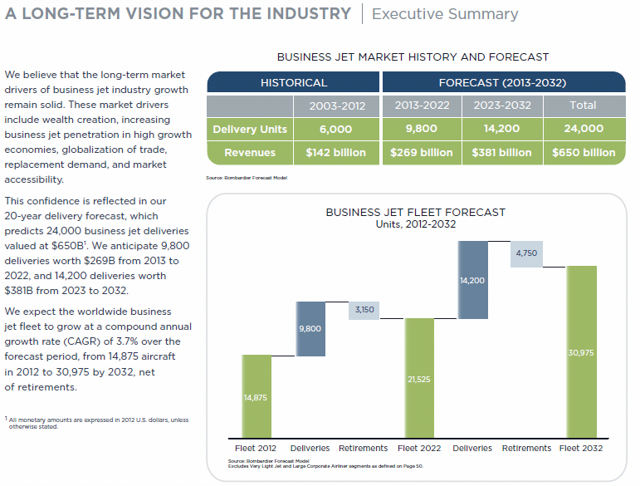

You can see that the market value of potential orders for commercial (100 seat) aircraft over the next twenty years is $4.4 trillion and the business jet market forecast projects $650 million in total new revenues over the same time period. In aggregate, there is the potential for over $5 trillion in new OEM orders over the next twenty years.

(source: Bombardier Market Forecast 2013-2032)

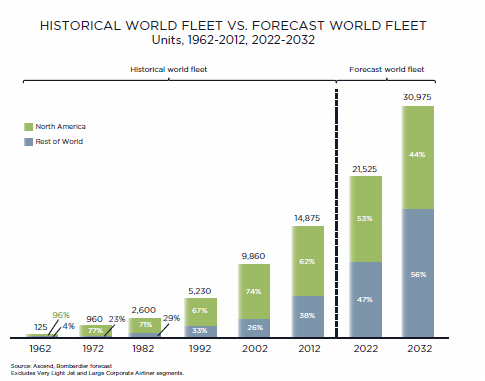

Like the growth in larger aircraft, the growth of the business jet industry will be centered on Asia, the Middle East, and other developing markets. Three quarters or more of business jets were bought by North American clients as recently 12 years ago, but that figure is expected to fall rapidly in the coming years.

(source: Bombardier Market Forecast 2013-2032)

Industry Dynamics

The industry has significant barriers to entry for new OEM and MRO players for two reasons, 1) An effective cartel/oligopoly and 2) significant consolidation within the industry itself.

It can be good to think of the aero engine development industry as very similar to the pharmaceutical industry. New aero engines are very expensive to develop and can take years to bring to the market but they have decent useful lives of anywhere between 20 and 35 years. These long useful lives also present an opportunity for part suppliers and MROs to service these engines for long periods of time creating a stable revenue stream.

The industry has set up a concentrated market structure that works very much like a cartel with various alliances and partnerships. These collaborations have spread the risk of developing new engine technology amongst all the collaborators with each sharing a set percentage of the costs and revenues. MTU has indicated that it prefers to stay below 25% per engine platform in order to diversify its risks.

When the cartel/partnership sells an engine or part, MTU receives its stated percentage of the profit whether they actually produced it or one of their collaborators did. If MTU produces it, they receive the production costs plus the same margin than if they didn’t produce it. The different companies within the cartel tend to specialize on different aspects of the development process with MTU focusing on high pressure compressors and low pressure turbines.

The second dynamic is partially a result of the first, with the industry undergoing significant consolidation within both the OEM and MRO marketplaces. The consolidation amid the OEM industry has been well documented and occurring for a long time with large jet manufacturing down essentially to a duopoly: Boeing and Airbus. However, the MRO industry’s consolidation has been more acute. The rationale for the consolidations are typically, cost reductions, diversification, horizontal or vertical “synergies”, geographic expansion, and defense (avoid a competitor from acquiring first).

From Airlines Business (Nov 1, 2012):

Various drivers are at work, such as the growing presence of OEMs in the aftermarket and the introduction of new-generation aircraft with different technical and support requirements. But the economic environment and consolidation in the airline business are the main driving forces behind the MRO sector’s development. Carriers are a catalyst for change in the aftermarket, as well as being affected by it.

As operators battle with low profit margins and the economic outlook remains uncertain – especially in the mature markets of Europe and North America – there seems to be little prospect for the airline industry to return to a more healthy balance of revenues and costs.

Power-by-the-hour style agreements with all-inclusive service on flight hour-based rates have become popular with airlines not because such arrangements necessarily provide the most cost-effective support, but because they offer financial planning security. With contract periods becoming longer, carriers are trying to hedge their bets and keep costs under control over the long term. But the result is that contract volumes have grown, providing airlines with more negotiating power versus their suppliers.

For the OEMs, this has been an opportunity to build their MRO footprint by sweetening equipment sales with aftermarket support deals. Third-party MRO providers, on the other hand, have responded to the trend by offering similar full-service contracts. But this type of agreement requires sufficient scale in the maintenance provider’s business to absorb the risks associated with offering technical services at flat rates over long periods.

Aero engine manufacturers and suppliers like MTU are of high strategic value to the larger aerospace players. The MA activity within the space has been considerable as larger conglomerates seek to vertically integrate MROs into their portfolio of offerings for their OEM products. Just in the last 18 months, GKN Aerospace purchased Volvo Aero for 8.6x EBITDA while GE bought Avio for 8.5x EBITDA. Given that Rolls Royce holds a 50% stake in ITP and IHI Corp. is a large Japanese conglomerate where engine MRO is a very small piece, MTU remains the only completely independent global engine sub-system provider in the market. Thus, it has a large bullseye on it for a potential strategic acquisition if any larger player wants to quickly add this potential large synergy to their fold.

Next-Generation Engines

The stock is down 13% over the last year largely due to investors feeling that the engine portfolio is outdated (along with weaker than expected spare parts sales growth). However, I do think the concerns are overblown as the company’s next generation engines will easily replace the recent engine retirements.

The PW2000 engine, which was largely responsible for the sentiment as the military retires the C-17 transport plane, and the CF6 are being replaced by newer engines. Within the narrowbody realm, the shrinking PW2000 fleet is at 1,700 versus a V2500 fleet of 4,500 with the expectation it will grow to 6,500 by 2016. In addition, the new PW1000G fleet has 4,500 engines on order. These engines alone make up for the loss of the PW2000.

Within widebody aircraft, the CF6 fleet of 3,200 is expected to decline to 2,500 by 2020, while the GEnx fleet is just beginning to ramp from the current 200, to 2,000 over the same time period. Additionally, the GP7000 fleet should increase from 300 to 1,000.

The V2500 engine is manufactured in conjunction with Pratt Whitney and Japanese Aero Engines Corporation. The two-shaft turbofan engine is geared towards short- and medium-haul aircraft and is currently installed in the Airbus A319, A320 and A321, as well as in the Boeing MD-90. This new engine lowers fuel consumption modestly but improves time on wing by 20%.

[Time on wing (TOW) is a measure of the operational reliability of an engine or aircraft system. Increasing TOW can significantly boost cost benefit and increase engine/aircraft availability by reducing engine downtime’s]

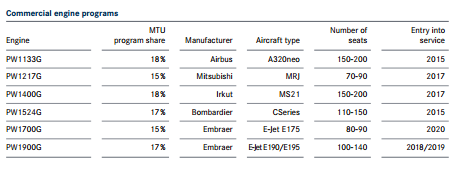

Below are the upcoming commercial engine programs that will provide ongoing new OEM orders and replace their retiring engines. Their ‘pipeline’ remains robust and given the industry dynamics, investors are downplaying the potential. As I noted above, airlines are looking at adding more single-aisle narrowbody’s. The aircraft below are on the smaller end in size and will be the primary load bearer as airlines look to add more direct flights and forgo the hub-and-spoke business model.

(Source: MTU Annual Report 2013)

Asian Expansion

The company recently entered into a 50/50 joint venture with China Southern Airlines to build a MTU maintenance facility in Zhuhai China. This is a new state-of-the-art facility that will accommodate engines up to 150,000 pounds of thrust. This is really a offensive move that allows the company to benefit from the expected growth in Asia for commercial and private jets.

In addition, this really makes the company much more desirable from an acquisition standpoint as any buyer would want a truly global footprint to their MRO operations.

Margins and EBITDA Ramp

The stock has also languished some due to the margin compression partly due to the timing of new engines and retirements of old engines. OEM new engine sales have been boosted to more than two-thirds of total OEM sales, up from a more typical 58%-62% of OEM sales. This has been due to timing of the ramp in GP7000 and GEnx shipments (and to a lesser extent the PW1000G) as well as the increase share of risk/revenue of the V2500 to 16% last year.

The notion on the Street is that the EBITDA and EBIT margins will slowly compress due to weakening product mix among other issues. However, MTU is aware of this and noted in their annual report that they intend to save several tens of millions of Euros per year through cost savings initiatives in order to maintain margins. It is unclear whether the expansion of their Poland plant – which runs much lower levels of costs – is included in that projection or not but could be an added bonus.

The specialization noted above within the cartel allows the company to forgo price competition which would otherwise pressure margins. This should help the MRO business stave off margin issues related to the business. The EBITDA margin dip of 2013 was due to weaker industrial gas turbine sales which are sold to power offshore oil platforms. This piece of the business accounts for approximately 10% of total sales within MRO. This should start to turn from a headwind into a tailwind this year as offshore rig counts start rising again. In addition, the MRO business underwent an expansion in both China (noted above) and elsewhere increasing overall capacity. Utilization rates dropped fairly dramatically hitting margins in 2012 and 2013. However, that should substantially reverse in 2015-2017 as demand increases as the V2500 sunsets and turns into an aftermarket product benefiting MRO.

Valuation

So, we have very favorable industry growth and dynamics along with depressed near term results due to investment, transitory product mix and other timing factors that will likely reverse going forward. This should lead to a strong EBITDA ramp going into 2015 and especially 2016.

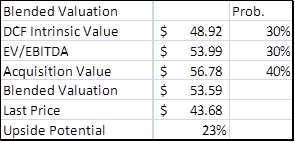

In my valuation, I analyzed the business both as an ongoing, standalone concern, and blended it with a takeover valuation, then applied a probability weighting to each.

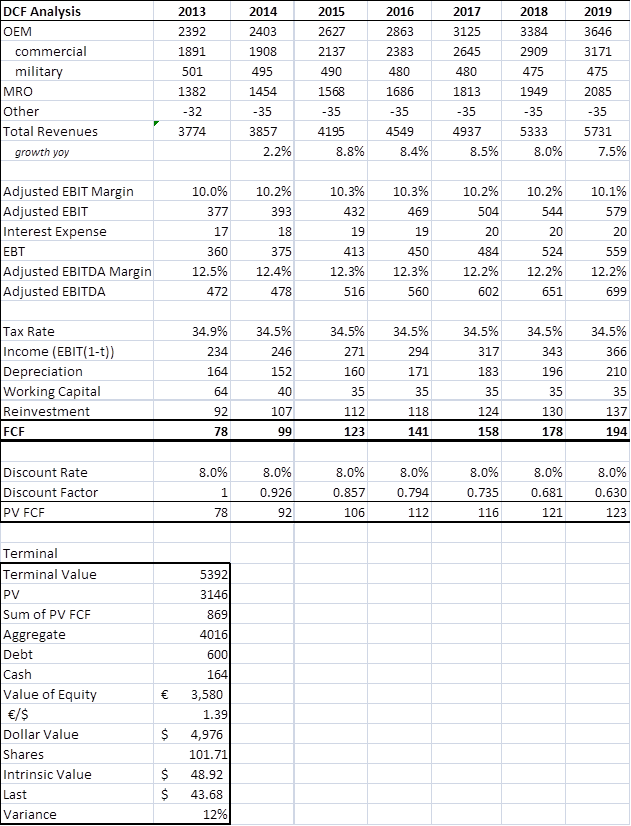

(Source: Author’s Calculations)

For the most part, my conservative discounted free cash flow analysis points to modest upside potential from here. The assumptions are used are all laid out for readers to see and make alterations if they wish. In fact, I ran several different scenarios whereby I tweaked sales growth, margins, and the cost of capital but settled on the above as my best guess for the current valuation. Some may argue that the cost of capital is too low but given the barriers to entry, the annuity-like stream of cash flows and the risk sharing from the aero engine industry consortium, the shares and company should have a lower risk rating and thus, discounting mechanism.

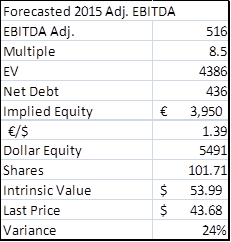

(Source: Author’s Calculations)

Using an EV/EBITDA valuation price target methodology, the expected ramp in EBITDA provides a slightly better upside target for the shares compared to the DCF model. The multiple I used is a bit elevated- although is close to the current trading multiple- given that it likely contains some takeover premium in it. However, it is highly unlikely that the premium will ever dissipate given the industry dynamics.

(Source: Author’s Calculations)

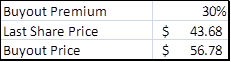

Lastly, I simply created a potential buyout price target for the shares assuming a 30% premium to the current trading price. While there is likely some premium built into the share price currently, it is likely a larger aerospace manufacturer would pay up to acquire the last true standalone MRO company.

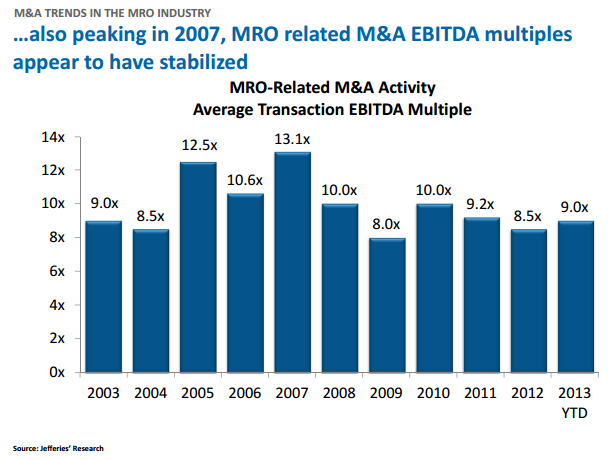

Below is a chart showing MRO-related MA transactions and the average multiple paid. If MTU gets bought for 9.0x its 2015 adjusted EBITDA, it would mean a share price of approximately of $57.50 or a third above the current price. This is probably a bear case scenario given it is only 0.5x above the current multiple and, as I noted above, a larger aerospace company would likely pay a decent premium in order to get it as the synergies and vertical (or horizontal) integration could more than pay for the additional premium.

(source: ICI International)

Blending the different valuation methods gets us a probability-weighted intrinsic value of $53.60, decent upside potential from here with the optionality of more if the acquisition materializes.

Catalysts

- Strong takeover target

- Asian expansion exposes it to the faster geographic areas expected for the next decade and a better acquisition target

- Fantastic long-term industry dynamics and tailwinds

- Overplayed margin story

Buying Shares

The OTC shares trade on very thin volume and can be hard to obtain if one cannot buy the MTX.DE shares that trade on the Xetra in Germany. I would recommend using limit orders given the bid/ask spread, currently 43.66/43.94 2×2. Splitting the spread can be an aggressive but safe way to get shares lifted.

Conclusion

This company offers investors a levered play on a long-term secular trend with a compelling valuation plus what I believe is near-term optionality given the strong potential for a takeover. The industry not only has great long-term variables for investors to consider, but the dynamics of the industry insulate MTU from price competition and margin erosion.

Editor’s Note: This article covers a stock trading at less than $1 per share and/or has less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Editor’s Note: This article covers a stock trading at less than $1 per share and/or has less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.