International Monetary Fund chief Christine Lagarde says the global economy is facing “the risk of a new mediocre, where growth is low and uneven.” Lagarde said Europe’s 18-nation bloc that uses the euro currency – collectively the world’s biggest economy – is facing the “not insignificant” risk of falling back into a recession. (VOA News)

Since at least the beginning of 2006, the most asked question I get after a speech is, “Do you think we will have inflation or deflation?” In an attempt at humor, my answer has been “Yes.” I go on to try to explain that we are in a deflationary environment, but eventually we will see inflation. When QE1 was announced, there were many pundits (none of the Keynesian variety) who immediately said the risk was for significant inflation, and there were even those (like Peter Schiff) who talked of hyperinflation and the demise of the dollar. Interest rates would rise, and U.S. government bonds would collapse.

My response at the time was that the Federal Reserve would print more money than any of us could possibly imagine (and who imagined $3+ trillion?), and we would not see any inflation. My reasoning was that we were in a deleveraging world where the velocity of money was clearly falling. I explained – once again – the relationship between inflation and the velocity of money.

Beginning with last week’s letter, “Sea Change,” my answer to that question for the foreseeable future will be simply, “Deflation.” In Endgame Jonathan Tepper and I described the economic environment of a deleveraging world, especially that of Europe. In Code Red we described the coming world of currency wars, with Japan having fired the first shot. Sadly, we continue to see the themes of those books play out in the real world.

Over the coming months we are going to explore the implications of a rising dollar for equity markets, global trade, commodity prices (especially oil), interest rates and Federal Reserve policy, just to mention a few of the areas that will be affected as global currency flows shift and protectionism is on the rise. Not all markets and governments will be affected in the same way, and there will be any number of opportunities for investors who are willing to think outside of the status quo.

In this week’s letter we’re going to explore some of the implications of deflation. We will start with an internal client letter from my friend Charles Gave that deserves to be shared. Then we’ll explore a few thoughts on the velocity of money. I should note that I am deeply indebted to Dr. Lacy Hunt for my understanding of the velocity of money. To the extent I get things right it is because of his frequent and long-suffering help, and if I get something wrong it’s because I didn’t understand the things he said correctly or couldn’t communicate them properly. These two men, both of whom I think of as mentors and statesmen, have had a huge impact on my thinking. The fact that they both talk with deeply resonating basso profundo voices that remind me of the voice of God in a movie soundtrack may have something to do with that impact! In any case, it lends an air of authority to their musings. Charles even has the long flowing white hair. (Thanks to David Hay for sending me the following note from Charles.)

The return of the XIX century panic?

The readers may have noticed that for the last few months, I have almost never written on economic activity, monetary policy or inflation. Most of my writings and presentations have been on one topic and only one, how to construct an “antifragile” portfolio to use the terminology coined by Nassim Taleb. For me, the monetary policy followed by the central banks had to lead to a collapse in the velocity of money, and from there to deflation.

My recommendation was thus to hedge any equity positions with a long-dated U.S. zero. So far so good.

Let me hazard for the first time in quite awhile a prognosis on the future of “economic activity” in the U.S. In the 19th century, which was deflationary most of the time, we did not move from a recession to a bear market, but from a bear market, called a “panic” at the time, to a recession. Let me explain.

When there is no inflation [see my notes below – John], the choices are between a deflationary boom and a deflationary bust. And the sober reality is that we move from one to the other only when the stock market crashes. What create the recession are not excess inventories or capital spending as in an inflationary period but the collapse in asset prices which had been pumped up by the general mood of optimism.

[Reread that paragraph at least a few times. We’re going to explore this concept further.]

Since we had plenty of debts attached to the prices of those assets, margin calls came in, and from there we moved to a true collapse in the velocity of money, accompanied more often than not by banks going belly up (see Barings with Argentina for a good example).

I have absolutely no doubt that trillions of dollars must have been borrowed one way or the other to play the rise in asset prices engineered by the central banks. Similarly, I have no doubt that huge amounts must have been borrowed to develop new sources of energy and that the break-even price for these new sources is probably being reached as I write. [Emphasis mine.]

To use my usual Wicksellian analysis, it is probable that the market rate is moving very quickly ABOVE the natural rate. If it were not, bonds would have no reason to outperform equities as they have for the last 12 months….

If I am right, it implies that a recession may be arriving and this recession should be preceded by a genuine collapse in bank shares, where most of the bad debt is probably parked and the bank shares are underperforming big time. The good news [is] of course that we are arriving at the end of one of the stupidest periods in economic history; the bad news is that asset prices will have to adjust to the new reality.

I maintain what I have said for a long time: No negative cash flows. No big debts. Hedge with government bonds.

The velocity trap

Hold those thoughts for a moment, as we need to explore the velocity of money a little further before looking at the implications of what Charles is telling us.

The St. Louis Fed defines the velocity of money as “the frequency at which one unit of currency is used to purchase domestically produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time.”

Irving Fisher gave us the famous Fisher Equation of Exchange. Reduced to its most simple form, it comes out as P=MV, where P is the nominal gross domestic product (not inflation-adjusted here), M is the money supply, and V is the velocity of money. You can solve for V by dividing P by M. By the way, this is known as an identity equation. It is true at all times and all places, whether in Greece or the U.S.

Saint Milton Friedman taught us that inflation is always and everywhere a monetary phenomenon. That is, if the central bank prints too much money, inflation will ensue. And that is true, up to a point. A central bank, by printing too much money, can bring about inflation and destroy a currency, all things being equal. But that is the tricky part of that equation, because not all things are equal.

What that means is that, to understand rate of change in pricing (known as either inflation or deflation), you must know not only the amount of money in circulation – the money supply – but the rate at which the money is circulating through the economy. If the velocity of money is slowing, the supply of money can rise without an increase in inflation.

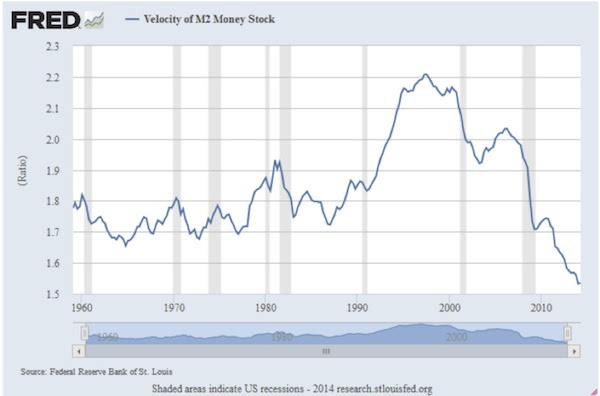

And that is precisely what has been happening. In fact, the velocity of money has been slowing since 1997 (back in the Clinton years – remember him?). But it slowed rapidly prior to both recent recessions and for the past few years has been falling off the cliff. The following chart is from the St. Louis Federal Reserve FRED database.

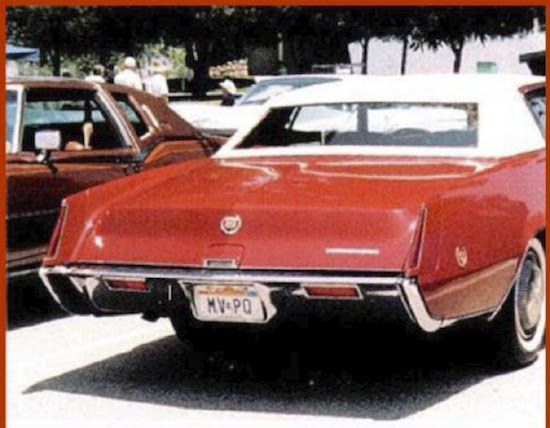

Note that when Milton Friedman did his famous study on the relationship between money supply and inflation he based his research on the period from the early ’50s until the late ’70s. The only way that inflation can only be solely a monetary supply phenomenon is if Fisher’s equation of exchange is not true. But Profrddot Friedman so firmly believed in that equation that he had it put on his license plate:

For the period of time that Friedman was studying velocity it was largely stable; but after he had completed his monumental research, velocity in fact did change, as we can see from the graph. (It is actually even more complicated than I will go into in this letter, as one has to look at demographics and population as well as productivity. But let’s not digress.)

If you were looking only at the St. Louis Fed chart, and you saw the little hook upward for the recent quarter, you might reasonably wonder whether velocity might not now be turning, since it appears to be at an all-time low. If velocity began to rise, would inflation come back?

Continue reading: http://www.mauldineconomics.com/frontlinethoughts/the-flat-debt-society